Know your Universal Account Number Status or UAN Status using Member ID / Aadhaar Number / PAN number at unifiedportal-mem.epfindia.gov.in website…..

Every employed person working in India must have a PF Account and a PF number which he or she will use to see and keep a record of his/her provident fund details. The PF Account is linked to the different employers of different firms. This means that in case an employee moves to another job, he or she will be given a new PF number, which is linked to the new employer. In October 2014, this organization introduced a service where an employee can handle all his Provident Funds accounts under one platform. In this article we can see detailed process on UAN Status checking procedure.

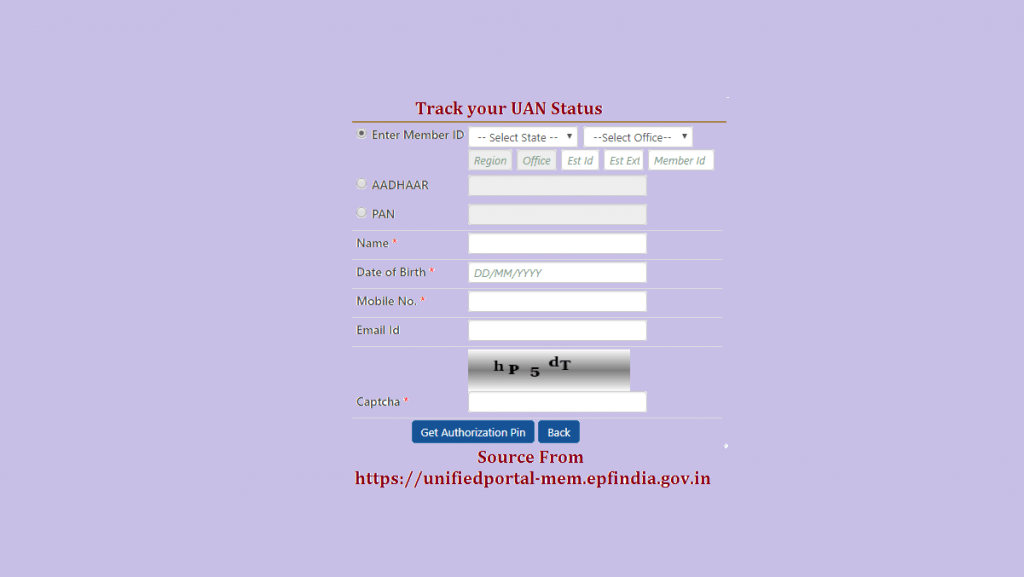

How to track your EPFO UAN Status through unifiedportal-mem.epfindia.gov.in

The following steps to give more data about on Universal Account Number Status shortly called as UAN Status. Here is the tracking process are as follows…

- Log in to the UAN online portal which offers the UAN services using this link https://unifiedportal-mem.epfindia.gov.in/.

- After logging into the above mentioned URL. On the screen, press on the tab with the option “Know your status” option.

- It will be redirected to a page where you will fill in the relevant spaces with the relevant information. Select your state and from the drop-down menu enter your member ID then followed by your other details like name, date of birth, registration mobile number, your email address, etc.

- Then press the option ‘Get Authorization Pin,’ and a new set pin will be sent to your mobile number, and this is the same point where you get to see if your status is active or not.

- Insert your new pin number and click on the ‘Confirm the One Time Password and get UAN’ option.

- After some few minutes, your Universal Account Number will be sent to your mobile number.

How to Know the Universal Account Number Status?

How to check UAN Status Online?

Visit the https://unifiedportal-mem.epfindia.gov.in/ after that you must click on ‘Know your UAN’. It is redirected to the another page. Enter your Mobile Number and Captcha code. Click on ‘Request OTP’. After entering the One time password it will show your status of Universal Account Number.

How to Get UAN Details?

Just type this URL in Google Chrome / Mozilla / Safari / Opera browser address bar https://unifiedportal-mem.epfindia.gov.in/. Just login to Enter your UAN and Password. After you can click on ‘View’ option then it will shows a drop down menu again hit on ‘UAN Details’. That’s it will shows the full information.

How to get my DOB of epfo

Hello sir/ma’am, I was working with reliance BPO in year 2011-12 and I have my pf in my account. I want to withdraw my PF. Please help me…

Hello Madam There is Now Very Simple Way to Withdraw PF ACCOUNT BALANCE IF YOUR UAN ACTIVATED MEMBER AND YOUR KYC DONE YOU CAN SIMPLY CLAIM THROUGH UMANG APP/UNIFIED PORTAL

Dear sir or madam, I was working with Bombay hospital from 2017 to 2019. I claimed for full withdrawal of the of. Bt I didn’t get the full amount. Can u please help me

I am change the previous company and working with second only one month currently I want withdraw my pf so please help me to solve this matter.

Company waley ne na to addahaar no dala he na to pan no dala UAN no kasey nikaley sir

Sir meri company ne to bhuhat badi galti ki hai mere saath meri date of exit Aur date of joining ek hi daal diya hai jiske wajha se main 6 month se bhag raha hu apne paise nikaalne k liye please help me

How can I know my date of birth which registered in UAN account?

I have lost my registered mobile number,s sim card

Jo tamaro uan number activate hoy to tame tamaro mobile number badli sako cho.

SIR HAMARA TWO MONTHS HO GAYE WITRAL BHARE ABHI BHI PROSESS ME BATA RAHA HAI SIR HAMARA PAISA ABHI TAK NAHI AAYA SIR

My PF NO 101560373798 LET ME NO MY BALAMCE AMOUNT

My request is to add trust related employees in EPFO portal whereas we can’t get any details in the portal as on date…

Companies that are running under a trust should be added in the portal will be the great. Everyone gets their EPF details in the portal.

Epfo portal so many barriers employees withdraw of

Dear mam / sir

I request to send pf transfe request in last two month before. But still not any status pls take action

Pf ni : 101171759300

Dear Sir , how is checkbook and passbook pf please tel details sir I want required money

Dear Sir/Mam

According to my perception the process of kyc update through Joint declaration is too lenthy make it easier so that pealple can withdrow their amount easily nd there is no any online option to check wether it is in process or not how can we aware of all thease

Hi sir madam sir mai apna pf account se paisa nikal na chata hn online nhe ho pa raha hai kaise karun

Sir,in my pf UAN no., wrong mobile no is written.How to change my mobile number in my pf UAN account.