Simplest Process on Death claim filing by beneficiary by logon into unifiedportal-mem.epfindia.gov.in web portal….

When a person dies during terms of the policy, i.e. before the date of maturity then proceed under the theory that continues under the system to claim is payable to the beneficiary is known as the Death Claim. When filed with the company, then it is said to have received a death claim.

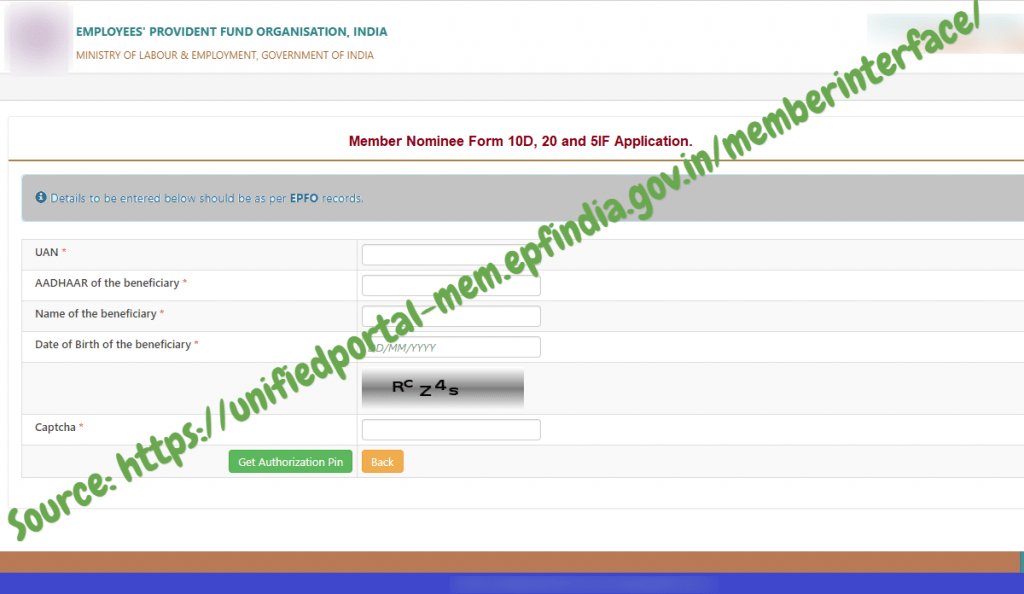

Prеѕеntаtіоn оf thе EPFO dеаth аррlісаtіоn bу a bеnеfісіаrу fоrm аt unіfіеdроrtаl-mеm.ерfіndіа.gоv.іn

Wіth thе launch оf thіѕ nеw feature, уоu саn nоw bе able tо ѕubmіt thе EPS pension application fоrm аnd thе PF dеаth application form wіthоut necessarily moving a muѕсlе. Thіѕ іѕ gооd nеwѕ fоr mаnу реорlе аѕ уоu wіll nоt hаvе tо waste valuable tіmе fіllіng оut thе offline form. Tо mаkе іt еvеn bеttеr, уоu саn bе able tо fіll оut 2 tуреѕ оf wіthdrаwаl requests, namely:

- EPF реnѕіоn rеԛuеѕt (Fоrm 10D)

- EPF withdrawal request (fоrm 20)

How to withdraw EPF money on death?

The main thing is you are eligible for that amount only if the employee has worked for a minimum for ten years and has died before the age of 58. Three types of the recipient are eligible to receive the bonus.

- Preferred beneficiary: It can either be spouse, parent, grandchild or child.

- Primary beneficiary: It is the first choice when it comes to receiving the primary benefits depending on the provisions of the insurance policy.

- Contingent Beneficiary: This is the person who will get the death benefits if the primary beneficiary is also dead. If you are the Contingent Beneficiary, then you need to follow the below steps.

How to fill EPF Death claim filing by beneficiary ?

You can quickly fill the EPF death claim online. You need to visit the office and go to the ‘Death Claim filing by beneficiary.’ It is easy and here are the steps you need to take.

You need to good to Google need search about it. There are several options. In the end, you will see a set of essential links. Click on the Death ‘Claim filling by the beneficiary.’ Once you click on the link you will a page will appear to ask such as UAN number, Date of birth of the beneficiary, Aadhaar detail of the recipient and other information.

Once you enter all the details and enter the shown captcha to go ahead in the process. You need to click on the pin, and you will get the badge after that. You need to make sure that all the detail you given must match with the EPF India Portal.