Procedure on Seeding or Link Aadhaar Number without UAN / With UAN in iwu.epfindia.gov.in/eKYC/ website…

The main reason for linking Aadhaar with your PF or UAN account is to make the verification process more straight forward in https://iwu.epfindia.gov.in/eKYC website. It also allows for bio-metric and demographic analysis of employees. The EPFO has gone ahead and provided a platform for EPF Aadhaar linking process, which is hassle free both through online and through offline platforms.

There are benefits associated with Linking your Aadhaar number with UAN and PF account. By linking the two, your account becomes more secure. This is because no other party can withdraw your funds except you. It also fastens your withdrawal process. With the EPF Aadhaar link, you can quickly close your account. You can do it online without the consent of your employer. Linking your account also ensures that you do not duplicate your EPF account with a similar UAN.

Link Aadhaar number without UAN / With UAN at iwu.epfindia.gov.in

If anyone Employee may unable to get Universal Account Number from the employer. You can get the UAN from the UAN portal too. You have to go through the Unified Member Portal.

A step-by-step description on how to Link your Aadhaar number with your UAN / PF account online.

- The first step is you need to open the official EPFO website. This can be done by using this link https://iwu.epfindia.gov.in/eKYC/

- A page will open named as the ‘Employees Provident Fund Organisation’. On the page you will be required to fill in your UAN and password that has been provided by the EPFO.

- Fill in your credentials (User ID & Password). Once the credentials are verified, you will see a tab ‘manager’. Click on this tab and select Know Your Customer (KYC) option.

- When you select the KYC option, the assigned fields that will require you to fill in your details will appear. These include your bank UAN, .

- You must ensure that the name used in your Aadhaar is the same name that you have used in registering your account.

- Make sure you check if all the information filled are correct. If there are errors ensure you correct them before moving to the next step.

- Select the ‘Submit’ tab. At this stage, your request will have successfully been submitted.

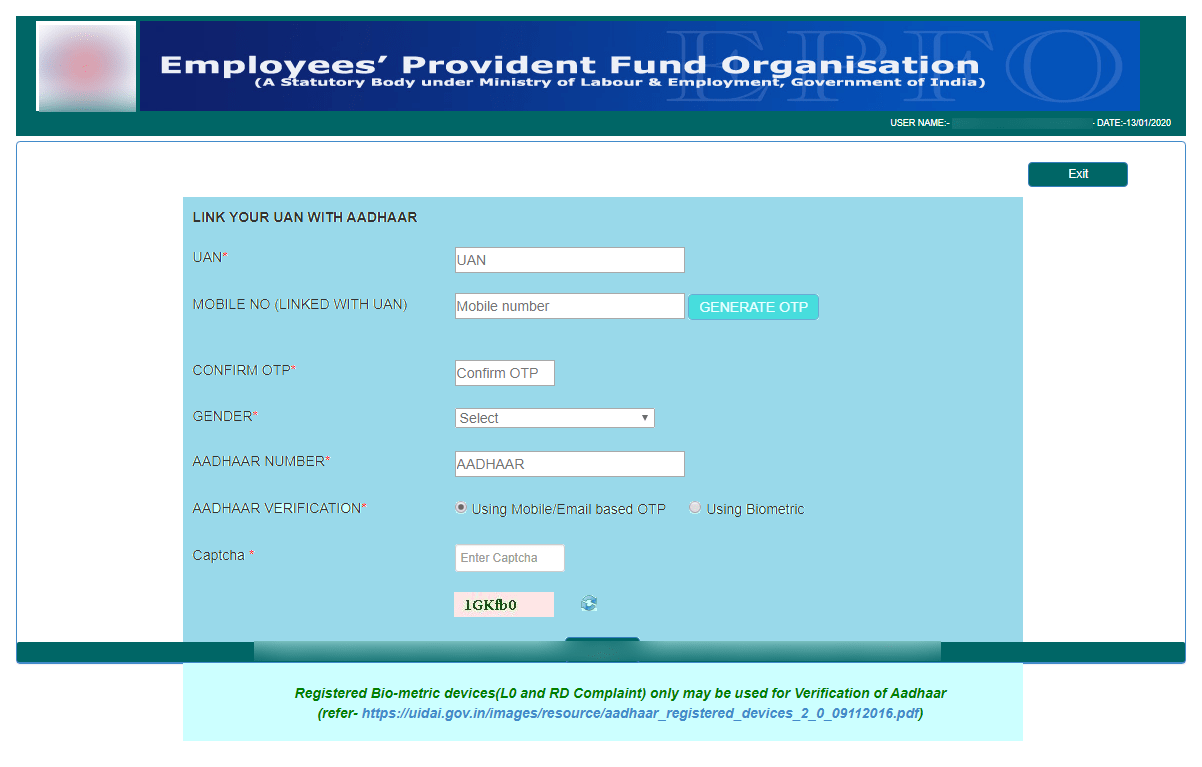

- Alternatively, there is also another way that you can link your Aadhaar with the PF / UAN using the offline platform by using the UMANG APP. It involves these steps UAN, Mobile Number, Confirm OTP, Aadhaar Number, Aadhaar verification and Captcha code. Click on Submit.

- Begin by downloading the UMANG APP. This app is available on the Google Play store and Apple IOS.

- On this app, you will realise that many online services are being offered. Search and click on the EPFO link.

- Click on the link this link which will direct you to the EPFO website.

- On the website go to KYC option and download an Aadhaar seeding form. If you are unable to download them through the site, you can walk to the nearest EPFO office and pick the form.

- Once you have the form fill in all your details including you Aadhaar and UAN number.

- Attach the form with your PAN and driving license.

- Once all the above procedures are fulfilled, submit these document to the nearest EPFO offices or the Common Service Centers (CSC).

Both of these procedures are easy and simple to follow. After submitting all the details, it usually takes around 15 business days to verify and link your Aadhaar number without UAN or with UAN at https://iwu.epfindia.gov.in/eKYC. Once your account has been successfully authenticated, you will receive a text from the EPFO confirming that your link has been created.

How to Link your UAN with Aadhaar number at iwu.epfindia.gov.in

How to Link Aadhaar Number with PF Account?

Visit the official portal of EPFO and login to your account using your UAN and password. Select the ‘Manage’ section and click on ‘KYC’ option. You’ll be redirected to a new page where you should select ‘Aadhaar’ to link with your EPF account. Enter your Aadhaar number and name as per your Aadhaar card before clicking on the ‘Save’ option.

How to Link Aadhaar with UAN?

Visit Epfindia website and click on ‘Link UAN Aadhaar’ option under ‘EPFO Members.’ Enter your UAN and registered mobile number before keying in the OTP received. Fill all the other details correctly, after which you should select ‘Using Mobile / Email based OTP’ for Aadhaar verification. Enter the Captcha and click on ‘Submit’ button to complete the process.

My pf UAN 10023668645 मेरा बेलेंस कितना है।बतायेंगे।

MY UAN No.100406817921 Name Of Vimal Turi

Please UAN Link With My Aadhar No.782536731128

My Registered Mobile No.7250770904

Thanking You

My EPF account number is GJ/5231/1321

Please show me my PF balance

UAN 101644848011

PAHLE DOB 01/01/2002 THI

AB 01/01/2005 kr dijiye