Procedure of Withdrawing Employee Provident Fund (EPF Withdrawal) using UAN Number in unifiedportal-mem.epfindia.gov.in website….

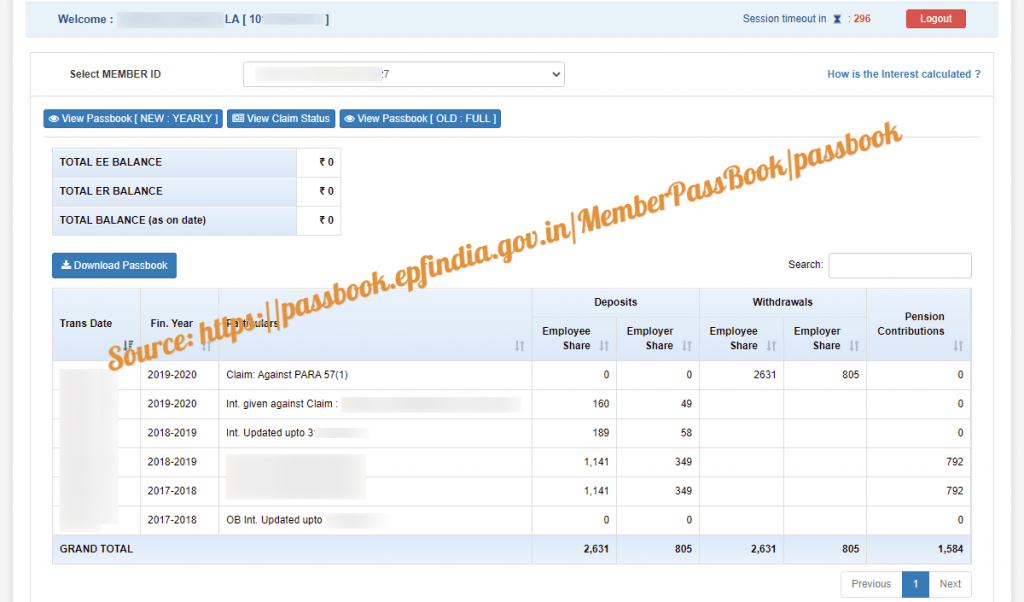

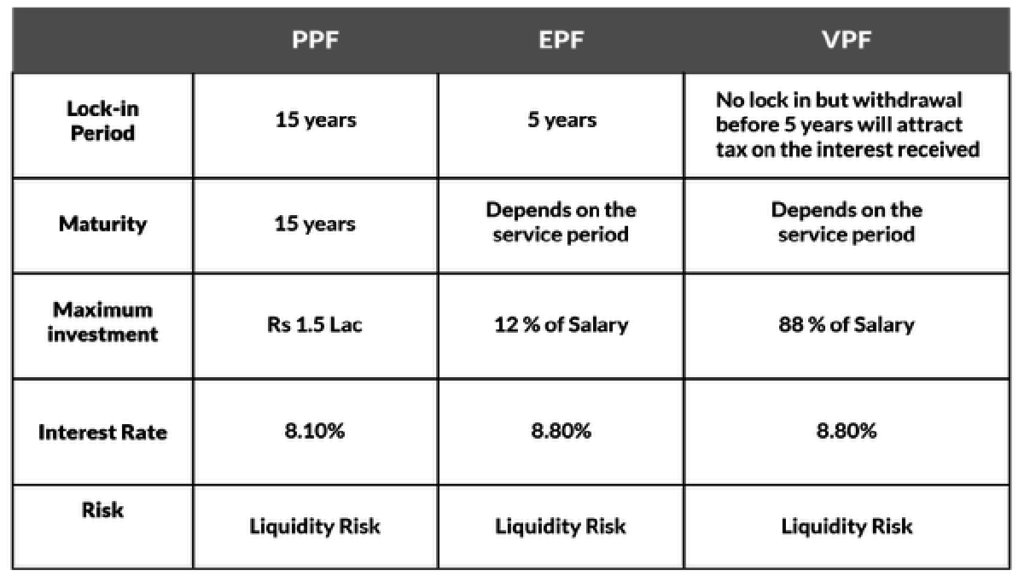

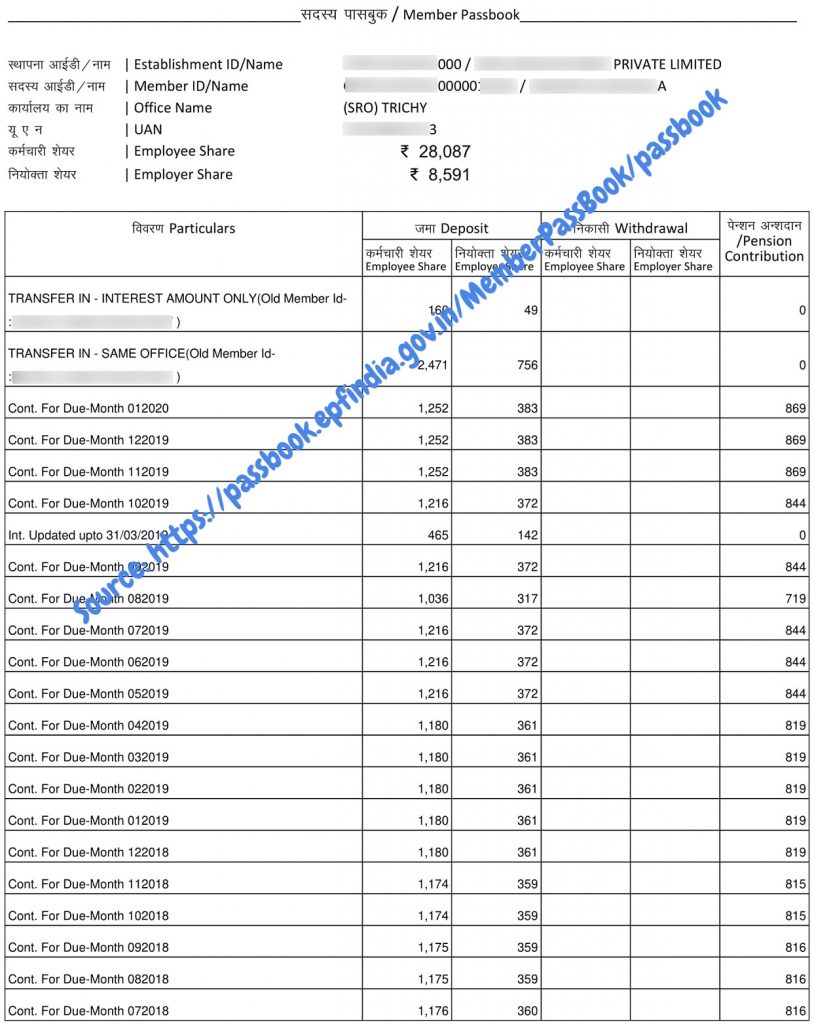

Provident Fund is one of the best tools for creating a financial corpus for the future. In this scheme, a part of the basic salary of the employee has reduced. As per the government instructions, the individual will get the interest on the amount. Once you take retirement then the whole amount, along with the attention, given to the employees. Some of the money will transfer towards the EPS [Employee Provident Scheme]. There are several ways you can check the amount of EPF here.

If you are retired and feel that you want to get your money, there is a EPF withdrawal procedure. An EPFO member has to wait for more than two months to apply for the withdrawal of his or her PF claims.

How to Withdraw EPF Balance Amount using Universal Account Number (UAN)

There are two main ways in which one can withdraw their EPF, and they include;

- PF Withdrawal by physical application

- EPF Withdrawal using the online portal

PF Withdrawal using the Physical Application

The first step is to visit the Employee Provident Fund Organization portal using this link: https://epfindia.gov.in uan login

- After logon into the above mentioned website.

- Go to the ‘Our Services’ option on the home page, and a drop-down menu will appear to select the option ‘Act and Schemes’ and click on it.

- You will be redirected to a new page showing you the provisions Act needed, one should download them.

- After downloading, fill in the new composite claim form and ensure that all details filled are correct.

- Submit your form to the respective EPFO jurisdiction office.

- After the organization has done the review, the amount claimed will be transferred to your bank account for easy withdrawal.

EPF Withdrawal by using the Online Portal

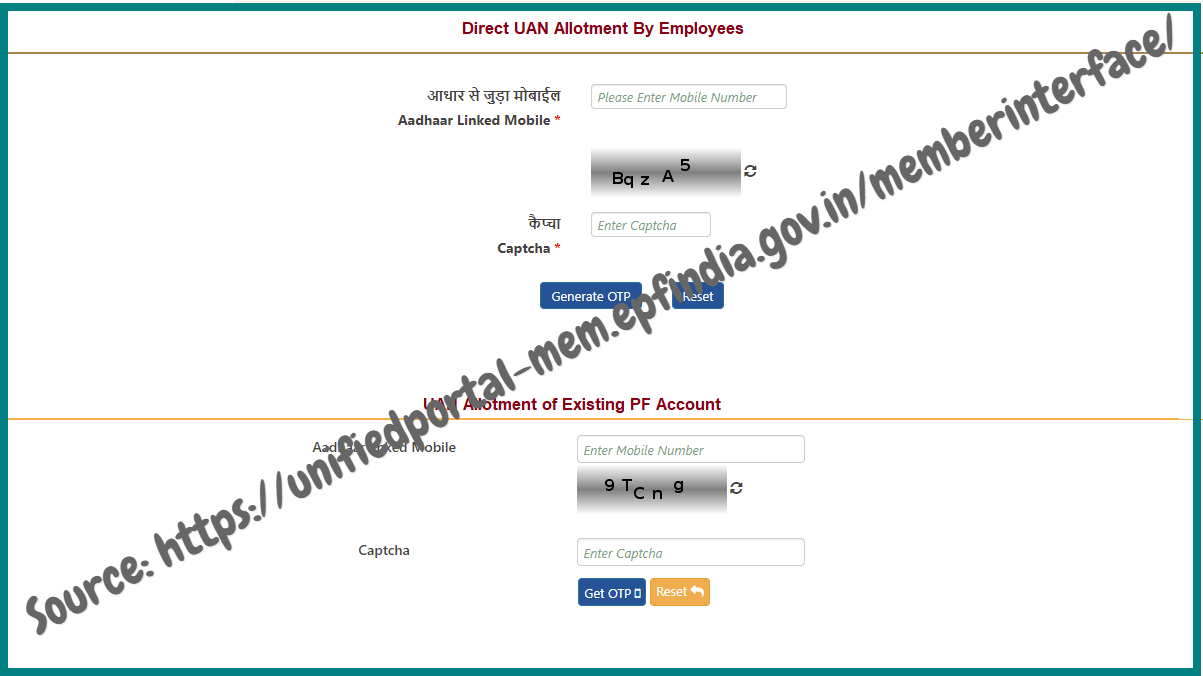

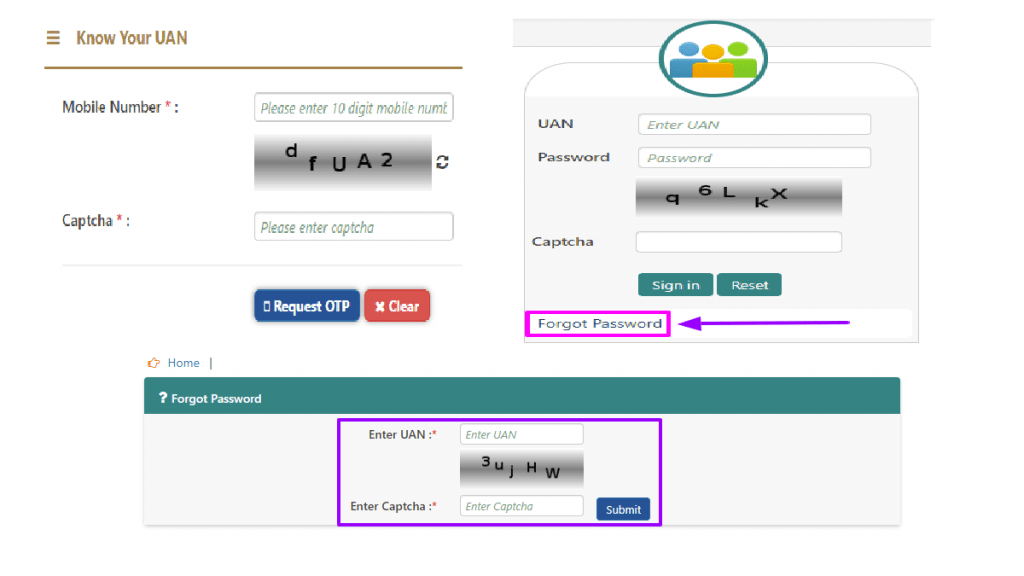

- To withdraw using the portal, visit the Universal Account Number portal using this link: https://unifiedportal-mem.epfindia.gov.in/

- On the right-hand side of the home page, you will be required to fill in your login details. Key in your UAN number, UAN password, finalize by entering the captcha code given below and press the option ‘Submit.

- Click on the tab with the option ‘ Manage’ and a drop-down menu will appear to select the KYC to confirm whether your KYC details like the PAN, Bank details and Aadhaar are accurate and verified.

- After your KYC details have been verified, on your homepage, go to the option ‘Online Services’ a drop-down menu will appear to select the option ‘Claim’ and press on it.

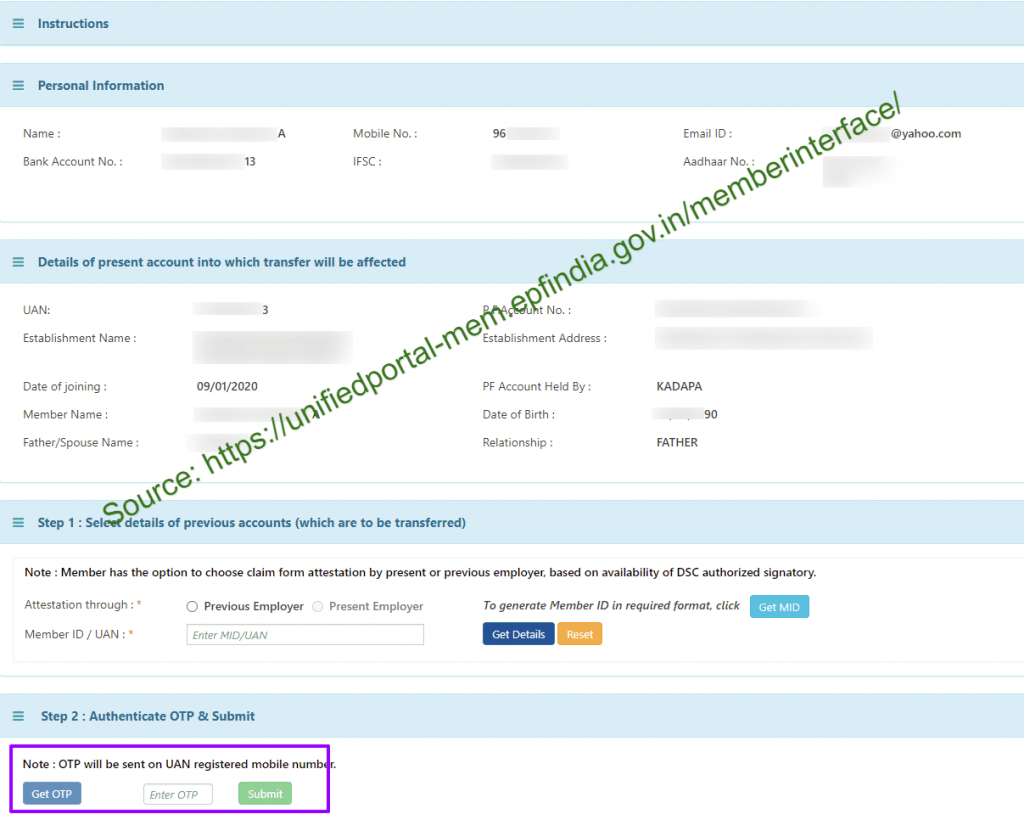

- You will be redirected to a new page where your ‘Claims ‘ will be displayed. You will be able to see details all your details and KYC details.

- The next step is to click on the tab ‘Proceed for Online Claim’ to submit your claim form.

- Ensure that in your claim you specify the type of application you require because there are different types, which include full EPF statement, EPF part withdrawal for either the entire loan or an advance, pensioned withdrawal and many more.

- Under the tab, ‘I want to apply for’ select your desired claim request and click on it. After some time your money will be deposited in your bank account.

- In case you notice that on the option ‘Proceed to claim’ that a drop-down menu is not appearing due to the service criteria it is important to visit the EPFO. This means that you are not able to receive these online services like pension withdrawal or PF withdrawal it is because you are not eligible for any EPF services.

It is also important for members to note that in case one is applying online for EPF partial withdrawal like a loan or an advance, you do not require submitting any documents for application.

How to Withdrawal EPF using UAN Number?

How to withdraw 100% PF amount?

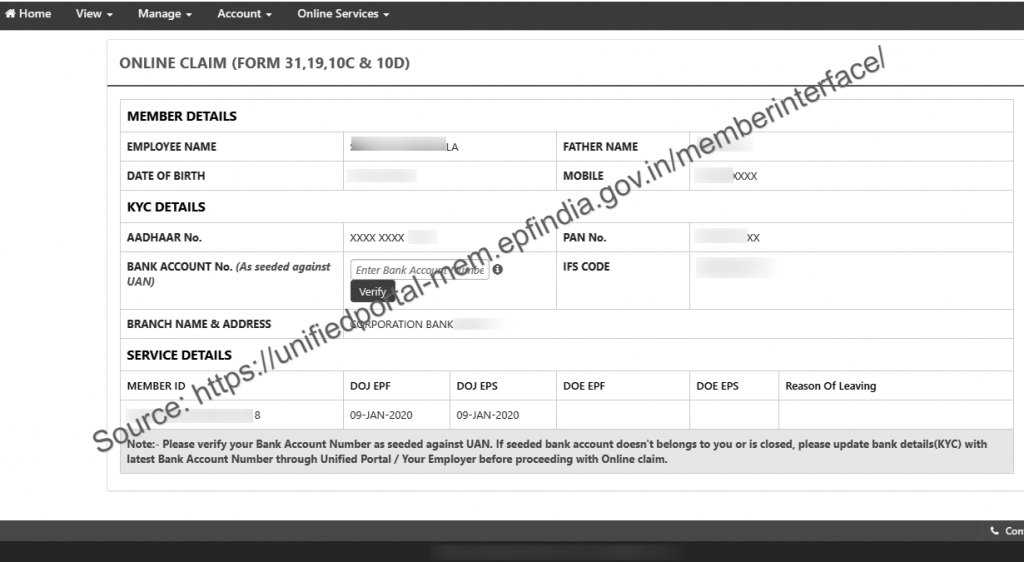

You will first have to Login to the EPFO website with your Universal Account Number (UAN), password and Captcha. Click on ‘Online Services’ tab and choose the relevant form from the options displayed. Enter the last four digits of the bank account number linked with the provident fund account and click on ‘Verify’ button.

How to withdraw PF amount using UAN?

First things first, login to EPFO e-SEWA portal using your UAN and password. After successful login, choose the relevant form (Form-31, 19, 10c & 10D) in the online services section. Enter your bank account details before confirming Terms and Conditions. Fill in the details before uploading the necessary documents. Enter the OTP sent to your registered mobile number to submit your claim application.