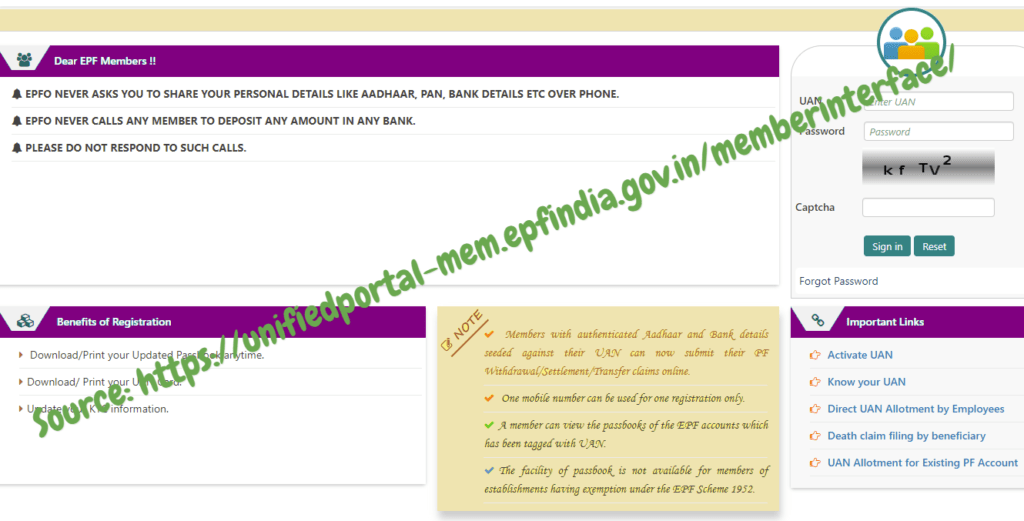

About the Universal Account Number officials of Unified Portal providing the Services Offered in https://unifiedportal.epfindia.gov.in/ website….

The launch of Employee Provident Fund Account unified portal has brought so much joy to employees under this body. This statutory body was started through the Employees Provident Fund Ordinance, which was passed in 1951. It is one of the largest social security organizations because it undertakes a high transaction volume and a significant number of beneficiaries. This is https://unifiedportal.epfindia.gov.in/ one of the official web portal for Universal Account Number Services.

The Central Board of Trustees is in charge of governing this scheme. They make all the important decisions related to the implementation and execution of this scheme. This organization introduced the online portal for employees to access services that they had to get by going to the EPF offices. The following are some of the services one can enjoy on the Employees Provident Fund Organization Member’s Unified Portal

Registration of Establishment

EPFO also introduced another online program known as the Online Registration of Establishment (OLRE) on their portal. The main aim of this program is to allocate PF code numbers to different establishments. Employers can now register their companies and organizations online through the EPFO unified online portal. To get help through their customer services one can contact them using this toll-free number- 1800 118 005.

Services List offered in unifiedportal.epfindia.gov.in website

Other services that are available for employees on the Employees Provident Fund Account unified online portal i.e https://unifiedportal.epfindia.gov.in/ include; E- nominations, online payment for EPF subscription, e-Challan submission, UAN helpdesk for employers, a portal for pensioners, COC Application Form and many more.

Online Claims

Members of the EPFO can submit online transfer claims instead of the previously used method of having to go to the EPF offices and being sent to the bank for confirmation. The EPFO unified portal has eased this process by enabling employees to submit their claims online. The process has been made easier and transparent for the employees. Through this online portal, members can transfer their claims from their previous employer to their current one. For those part where your employer is the one to fill in, he or she can do that online and then submit the documents online.

Updating the Provident Fund Accounts Details

The other services that employees registered under EPFO can enjoy are updating their know-your-customer documents and get them approved by their employers. In case you want to change something, for example, a new email address through the online portal you need to enter your Aadhaar, your bank details, other KYC documents like driving license, passport, electronic cards, and PAN number. Once these documents have been approved, the claim process becomes more straightforward and more accessible. Therefore, one can update their PF account KYC documents through the EPFO unified online portal https://unifiedportal.epfindia.gov.in/.

Link your Universal Account Number to Aadhaar

Instead of going through the whole process of going to the Employee Provident Fund offices and involving your employer to help you link your UAN to Aadhaar you can do it yourself. It is mandatory for all employees to link their UAN to Aadhaar, a process that one does through the online portal provided they have their UAN number. One can link UAN to Aadhaar provided their account has been active in three different ways. They include; through the e-KYC portal, using the UMANG Application and using the Universal Account Number.

Get UAN Member Details

An employer can find out about a particular UAN member online by going to the Employee Provident Fund Organization official portal. He or she is only required to provide some necessary information about the employee, for example, an establishment code, mobile number registered in the ECR portal. If the information he provides is validated, he or she will get a one-time password, and after entering it, he will be redirected to a new page with all the details about that particular employee.

Edit profile details

An employee can be changing his or her details through the online portal. In case, you made a mistake when entering your details for example misspelled your name or entered the wrong identification number, and you can easily undo the mistake by login into the portal. A verification process will be conducted to ensure that it is you and if everything is verified and okay, the changes you made will be applied. You can rectify your mistakes through the online portal without much hassle.

UAN Member e-Sewa for Employees

e-Sewa is another facility on the EPFO online portal. Members will be required to register for e-Sewa services using the Universal Account Number. The e-Sewa portal allows employees to enjoy services like updating KYC information online, download the EPF passbook, downloading the UAN Card and many more. Members can also get register and get their Universal Account Number and their member ID through this portal. To get most of these services, members’ had to go and take long queues at the EPFO offices which were time wasting. Nevertheless, through the introduction of the new portal members can now enjoy these services and more.