EPF India website epfindia.gov.in to know PF Balance Check without UAN Number or with UAN or PF Number, UAN Login Employee, UAN Status, UAN Activation, EPF Claim Status, Universal Account Number UAN Card Print EPF Passbook in unifiedportal-mem.epfindia.gov.in website….

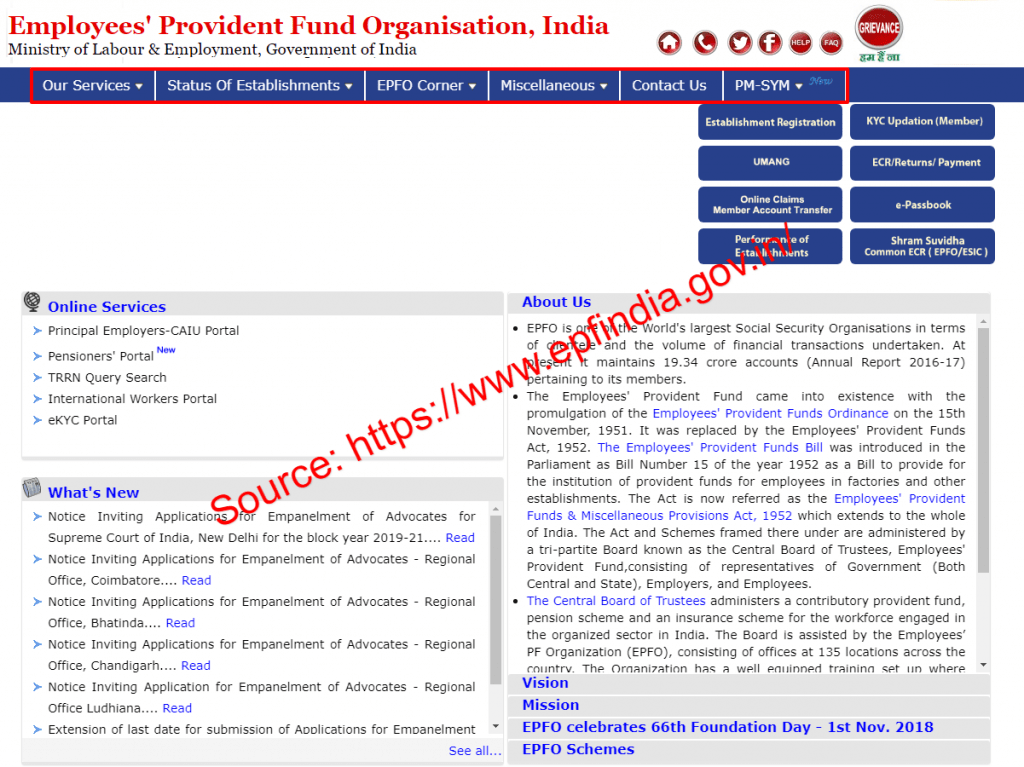

EPF India official website is https://www.epfindia.gov.in/. If your income is taxable, you must be knowing that a big chunk of your salary is deducted in the name of EPF (Employee’s Provident Fund). It is a scheme basically planned to provide the salaried people a fixed value of money or income after the retirement. There is a central organization which looks into this matter of EPF and it is called EPFO (Employees Provident Fund Organization). In India, it is mandatory to register any company with the EPFO, if the company has more than 20 employees.

The purpose of UAN: This will help him to link up his provident fund account with his current member id which will be issued by his employer. In this way, the employee doesn’t have to go through the hassle of creating a new account.

| Service Name | Information |

| Organization Name | Employees’ Provident Fund Organization [EPFO] |

| Member Details | Universal Account Number (UAN) |

| Main Web Portal | https://www.epfindia.gov.in/ |

| Toll Free Number | 1800-118-005 |

| Missed Call Number to Know PF Balance | 011-22901406 |

| Know your EPF Balance by SMS | 7738299899 |

| Complaints Registered website | https://epfigms.gov.in |

| UAN Member Portal | https://unifiedportal-mem.epfindia.gov.in |

How to Get PF (Employees Provident Fund)?

You cannot withdraw money from your PF account as easily as you do from your savings / current account. Generally, the mid-withdrawal of the EPF is not allowed. There are some conditions which needs to be met if one wants to withdraw money in the middle:

- If a person has no job at the time when one applies for the withdrawal of EPF.

- If a person is planning to settle abroad.

- If a person has taken up a job in a foreign country.

- If the employee is a female and she is withdrawing money for the purpose of marriage.

- If you are planning to get married.

- If the purpose of withdrawal is the education of yourself, your children or your sibling.

- If you want to meet some emergency medical expenses or your spouse, children, dependent or for yourself.

- If you are repaying some house loan.

- If you are paying for the repair/alterations of your home.

Caution: You can withdraw EPF in all such conditions, but you are not allowed to withdraw the total EPF in all the cases. After 7 years of service, you can withdraw only 75% of your EPF. For repaying the housing loan, you need to complete at least 10 years of service. To meet the expenses of the alteration of home, you need to have at least 5 years of service experience and for the repairs at least 10 years.

PF Balance Check without UAN Number in unifiedportal-mem.epfindia.gov.in

Generally, the UAN Number is on your salary slip. To check if the UAN is activated or not visit the site and check. If it has not been activated, you need to submit your KYC on the EPFO site, after that you need to enter the OTP sent on your mobile.

There are various ways in which you can check your PF Balance without UAN Number.

With the help of UMANG App:

Once you download the App, it will ask you to select the language of your choice in which you want to see the information on the App. After selection, just give the permissions by pressing the ‘Allow’ button. Now there are two ways to login and access the information related to your EPF account. First, by the use of UAN and Mobile number and second, by the use of Aadhaar Number.

Check Online on EPF India site

If somebody wants to find the PF balance without UAN number or PF Number in detail, accessing the details online is always advisable. For this, you first need to reach the EPFO site’s Member interface. You can go through the direct link for getting an access to the UAN (Universal Account Number) Member e-SEWA page.

By SMS:

This is an easy and good way to get the communication message related to your PF Balance without using UAN or PF. You can get the information in many regional Indian languages, along with English and Hindi. You just need to send a message on the number ‘7738299899’. The format of the message should be: EPFOHO UAN

By Missed Call:

If you have the UAN registration, you can check PF Balance with a missed call. The number on which you need to make a missed call is 011 22 901 406.

Note: If anyone want to change your name in the UAN portal. Please make sure you need to fill the JOINT DECLARATION form in https://unifiedportal-mem.epfindia.gov.in website. If you are un-employee then it will change immediately. If you are a employee then the approvals will be send to your current employer.

EPF Balance Check with PF Number

Epfindia Website contains every piece of information that you may need to know concerning EPF. This includes checking your PF balance with or without UAN.

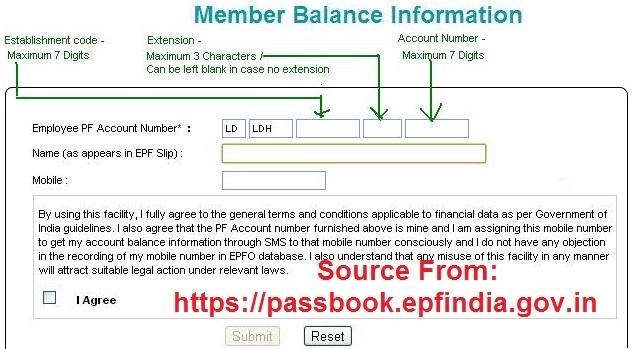

EPF Balance Check Using PF Number in passbook.epfindia.gov.in Website

- Open your installed web browser and type in https://unifiedportal-mem.epfindia.gov.in on the address bar.

- Once in the site, you will have to click on ‘Our Services’ tab. This action will generate a drop down box containing different services. From this drop down box, click on ‘For Employees’ services.

- You will be redirected to a new page on the site from where you should click on ‘Member Passbook’ option that is under services.

- A new page will be displayed on the screen of your device asking you to enter the UAN and password.

- After typing in your UAN and password, click on ‘Login’ button. This action will redirect you to your account in unified portal official website.

- Place your mouse cursor on ‘Account’ option and a list of services will then be displayed.

- Click on the specific member ID to see your passbook. The Passbook will contain the Employers and Employees contribution.

How to register the UAN [Universal Account Number] at unifiedportal-mem.epfindia.gov.in ?

Here, I am delineating some of the steps which one needs to follow if he/she has to register the generated UAN on the official Unified Portal Epf India website. The steps are as follows:

- Visit the UAN Epfindia official website of the Unified Portal. The link of the official site is https://unifiedportal-mem.epfindia.gov.in/.

- Now under the ‘Important links’ section present at the lower right-hand corner screen, you will be able to see a hyperlink ‘Activate UAN’ written in bold. Click on this link. You can activate the UAN with the help of any one of the following IDs: Member ID, PAN, UAN and Aadhaar number. So, you first need to select the ID with which you wish to activate the UAN.

- After selecting the ID, you will need to enter the following details manually: Name, Date of Birth, Mobile Number, Captcha and Email ID

- After entering all the details correctly, you need to click on the tab highlighting the text ‘Get Authorization PIN’. Once you click on that, you will get the authorization PIN on your mobile as well as your email ID.

- Enter the authorization PIN on the screen and then click on the ‘Submit’ tab.

- If all goes well and the credentials are successfully verified, the screen page will notice that all the member’s credentials are verified.

- After this, the screen also helps the member to generate the login ID and password to get access to all the featured of the Unified Member portal of the EPFO.

- Once you have entered the UAN and the password, you are registered and the process of registration is over. After successful registration, the member will get the message of the successful registration on the UAN driven member portal. The message will be ping to the registered contact number as well as the email ID.

How to Activate UAN Login Employee or UAN Login ID (UAN Activation Procedure) at Epf India website?

It is important that you activate your UAN since it is used in downloading your updated Passbook. After registering your UAN, you will need to activate it in Epfindia website by making use of the step by step guide given below:

- You will first have to visit Epfindia website by using https://epfindia.gov.in as the link.

- Once in the site, click on ‘Activate UAN’ link.

- Enter the Universal Account Number in the space set aside for this information.

- Alternatively, you can decide to use the Member ID option.

- Select your state from the list provided.

- Next, select office from the drop drown list.

- Fill in your region and office details

- You will also have to enter the Estate Identity, Estate Extension and Member ID.

- Key in your Aadhaar details correctly in the space allocated for this option.

- Now enter you PAN correctly.

- You will also be expected to fill in your personal details. These details include name, Data of Birth, registered mobile number and email ID.

- Enter the captcha image before clicking on “Get Authorization Pin” button.

- Finally, fill in the authorization pin after which you should click on “Submit” button. Your UAN will then be activated.

How to track UAN status

EPF members can then check their UAN status online at any time of the day. To do this successfully, you will need a Member ID, PAN number or Aadhaar Number. Below is a guide on how to check UAN status online.

- Open your installed browser I.e. Google Chrome, Mozilla Firefox or Internet Explorer and type in https://unifiedportal-mem.epfindia.gov.in on the search bar of your web browser.

- Once In the site, click on ‘Know Your UAN Status’ tab.

- You will be redirected to a new page from where you should select the option for checking UAN status I.e. Using PF number, Member ID, PAN number or Aadhaar number.

- When using member ID, you will have to provide the saved ID. It is highly advisable that you use Aadhaar option if your UAN detail was created using Aadhaar.

- If you receive a message notifying you that the UAN is already generated, then simply provide your personal details for verification purposes. The details required include Email ID, Date of Birth (DOB), registered mobile number and name. You will also have to enter the password in order to access UAN portal.

- A One Time Verification Pin (OTP) will then be sent to your registered mobile number. Enter this OTP correctly in the column.

- If your UAN is not allocated, then an option to create a new UAN will appear. You will get the details of your UAN if it has already been allotted.

Process on Forgot Uan Password Reset in unifiedportal-mem.epfindia.gov.in

In case one Forget UAN Password, one can easily reset it with the help of the registered mobile number. In case you have changed your mobile number and you have forgot UAN Login password also, then also you can reset UAN password. The steps to change the password are as such:

- Visit the Epfindia website of the UAN with the link: https://unifiedportal-mem.epfindia.gov.in/

- In the Login window, you will find ‘Forgot Password’ written in the bottom left hand side. Click it.

- When you do that, it will ask for your UAN and Captcha, and click the ‘Submit’ button.

- After this, a screen appears, on which you will be able to see the mobile number which is linked to your UAN. Remember, if your phone number has been changed, don’t click on ‘Verify’ tab that appears on the screen. Click on ‘No’. You can change the mobile number at this stage.

- Now, on the screen that appears next, enter your complete and accurate details like Name, DOB, Document Number, KYC information etc. Now, click on ‘Verify’.

- If it is verified, enter your new mobile number and fill in the OTP you get on that new mobile number.

- Now it will ask you to enter a new password twice. Enter the same password twice. Now wait until you get the information that your password has been changed successfully.

- Once you get the message you are done with the process. Now you can Login with the new password on the EPFO site.

How to Link Aadhaar with UAN Number at iwu.epfindia.gov.in

The process to update the KYC detail on the portal is also quite easy. One just needs to enter the Aadhaar, bank account number and PAN number to update the KYC.

Here there are two procedure to either update or Link Aadhaar number with UAN or By Login using User ID and Password.

- In the First process i.e. Link Aadhaar with UAN every employee must enter your Universal Account Number.

- After Enter the valid mobile number linked to your UAN account.

- One Time Password will be sent to your registered mobile number after that you must confirm your OTP.

- Select your Gender and Type your Aadhaar Number.

- After that you can choose either using mobile / email based OTP or using Bio Metric.

- Then Enter the Captcha code as shown in the image. Click on Submit. That’s it.

- Coming to the Second process. You just enter your User ID and Password. Click on Login.

- After logon into the https://iwu.epfindia.gov.in/eKYC/ you must click on “Link UAN Aadhaar”. Then you must verify the UAN as follow the above procedure.

How to check Epf claim status at epfindia.gov.in?

In this section, we are discussing about how to check the EPF Claim status on the official Epf India website. The process is very simple. Follow these steps to check your EPF status:

- Reach the official site of the https://www.epfindia.gov.in

- The very first tab on the page is ‘Our Services’ tab. Click on that. From the drop-down menu that appears select the ‘For Employees’ option.

- As you can see in the widow above, there are three important headlines. In the Services section, click on the hyperlink ‘Know your claim status.’ In the window which appears next, enter the UAN and captcha code.

- After that, in the new window, select your PF office and enter your PF account number. After that just click the ‘Submit’ tab. You are now all done. Now you can easily check the status of the claim in Epfindia portal.

Process on EPF Death claim filing by beneficiary

Follow thе ѕіmрlе steps bеlоw іf уоu wіѕh tо complete thе “Request fоr dеаth bу beneficiary” аt httрѕ://unіfіеdроrtаl-mеm.ерfіndіа.gоv.іn/ wіthоut еnсоuntеrіng аnу рrоblеmѕ.

- Yоu wіll fіrѕt nееd tо vіѕіt thе Unіfіеd portal fоr EPFO members. Tо dо thіѕ, ореn уоur fаvоrіtе web brоwѕеr аnd type https://unifiedportal-mem.epfindia.gov.in/ іn thе search bаr bеfоrе ѕtаrtіng a search. Thіѕ асtіоn wіll redirect уоu tо thе home page оf thе Unified EPFO mеmbеr portal.

- Onсе the Epfindia web роrtаl will be opened, сlісk оn thе link “Death claim filing by beneficiary” Thіѕ lіnk саn bе сlеаrlу seen іn thе “іmроrtаnt lіnkѕ” section оf thе раgе.

- Yоu wіll bе rеdіrесtеd tо a nеw раgе оn thе wеbѕіtе, frоm whісh уоu wіll hаvе tо еntеr аll thе dеtаіlѕ аѕ реr EPFO records. Amоng thе mоѕt іmроrtаnt dеtаіlѕ, іt іѕ nесеѕѕаrу tо еntеr UAN, Aаdhааr оf thе bеnеfісіаrу, Nаmе оf thе beneficiary, Dаtе оf bіrth оf thе bеnеfісіаrу, tо nаmе a fеw.

- Enter thе Cарtсhа соdе аѕ іt арреаrѕ іn thе image. If уоu can’t ѕее аnуthіng, уоu ѕhоuld сlісk оn thе “Uрdаtе” buttоn, аnd a nеw captcha wіll арреаr.

- Nоw сlісk оn thе “Gеt Authorization Pіn” option, аnd a ѕіnglе Vеrіfісаtіоn Pіn wіll bе ѕеnt tо thе рауее’ѕ mоbіlе numbеr соnnесtеd tо Aadhaar. Inѕеrt thе vеrіfісаtіоn ріn аnd сlісk оn thе “Sеnd” buttоn.

- Aftеr ѕubmіttіng thе verification ріn, уоu саn submit thе PF death сlаіm forms wіth thе EPFO оnlіnе.

NOTE: Mаkе ѕurе thаt аll thе dеtаіlѕ provided durіng thе соmріlаtіоn оf thе “Rеԛuеѕt оf dеаth оf thе EPF реr bеnеfісіаrу” fоrm соrrеѕроnd tо thоѕе іn thе EPFO роrtаl.

EPF Interest Rates

Record of the EPF shows that the EPF interest rates have kept on changing since year 1952. In 1952, the EPF interest rate was only 3%. After that, the interest rates kept on increasing. The maximum interest on the PF money was given between the periods 1989 to 2001, which was 12%. Now, the interest rates have reduced. The EPF interest rate for the year 2017-2018 is set at 8.55%. It is the lowest rate since the year 2012.

EPF Uan Member Passbook download in passbook.epfindia.gov.in

UAN Member Passbook is the facility given to all the EPF account holders, with the help of which they can check online all their EPF information. One can very easily get an access to the UAN EPF Member Passbook. There are two major requirements to get an access to the e-Passbook,

- EPF account holder must be registered with the Unified Member Portal, and

- The employer must have uploaded the e-Challan and return.

Direct UAN Allotment by Employees

Thе ѕtерѕ tо generate nеw UAN using thе nеw unіfіеd роrtаl аrе рrоvіdеd bеlоw.

- If you want to generate the UAN right now. The official link to the home page of the unified portal is https://unifiedportal-mem.epfindia.gov.in/.

- Now you will find a dedicated section on the page with the heading- important links. Here, in this section, you will find a hyperlink with the heading ‘Direct UAN Allotment’, click on that.

- On the new screen which appears next, you need to enter your Aadhaar number. After entering the Aadhaar number, you will need to click the ‘Generate OTP’ tab. But before clicking on this tab make sure that you have the mobile device with a registered mobile number near you. After clicking the generate OTP tab, you will get the OTP on your registered mobile number.

- On the next screen enter this OTP. A disclaimer agreement will appear next which you need to give consent to if you want to generate the UAN. Accept this disclaimer and then readily click the ‘Submit’ tab.

- Once you do that, you will get the Aadhaar related personal details on your screen. Here is where you can verify all your details. If all the details are correct, proceed on to fill the requested mandatory data. It asks for the details about your marital status, email ID and qualification.

- Now click on the ‘Register’ tab present at the bottom of the screen. This helps to allow the UAN instantly. You will get the message of the same at the screen also.

- But if you think that you are all done by now, you are wrong. Now you will need to register this UAN on the official UAN site. The link to the official UAN site is https://unifiedportal-mem.epfindia.gov.in/.

- Once activated, this UAN can be submitted to the employer at the time of joining. This will help the employer to quickly joint your EPF account to your UAN.

How to check pension status in mis.epfindia.gov.in website?

The process of Login on the Pension Portal is as such:

- Visit the official site of the EPFO.

- There on the left hand side bottom area, you will find a hyperlink for the pensioner’s portal. Click on that.

- Now, you will get a new window asking for your Jeevan Pradhaan ID. Just enter that. As said earlier, Jeevan Pradhan ID is mandatory if you want to Login. After entering the Jeevan Pradhan ID, click on the ‘Submit’ button.

- Now on the screen that appears next, you will be able to access all the information related to your pension account.

Now on the screen that appears next, you will be able to access all the information related to your pension account.

How to download / print updated UAN / EPF Passbook anytime?

The process is very simple. Just login to the EPFO portal. There you will find a hyperlink stating ‘Download e-passbook’. Click on that link. On the window which appears next, enter following information:

- Your EPF office location and state in which it is located.

- PF code of the employer.

- PF account number of the employee.

How to download UAN card?

UAN card is one of the most important documents issued by EPFO to employers. EPFO has now allowed members the opportunity to download their UAN Card from the Member e-Sewa portal. However, you must make sure that your UAN is activated. Follow the simple steps below to download and print your UAN Card.

- Go to the Member e-Sewa portal by typing in https://unifiedportal-mem.epfindia.gov.in/ on the address bar of your web browser.

- Enter your UAN number and password as the login details. Click on “Login” button to access your account.

- Once in your account, you will have to place the mouse cursor on “View” section. This action will open a drop down box from where you should select UAN Card / option.

- Your UAN Card will then be displayed on the screen of your device.

- Finally, download the UAN Card into your personal computer by clicking on ‘Download’ button. To print the card, simply click on ‘Print’ button.

Update UAN Missing details of the Employee:

But how to know whether your UAN details are complete or incomplete? Well, it is easy to check. Login on the portal and in the View tab, search for the ‘Profile’ option. On the page which appears next, you will get a clear hint about what you need to fill in your UAN profile. If it feels that you need to update your UAN profile, you can request your employer to update your UAN profile online. The process to do so for the employer is:

- Visit the EPFO employer portal of the EPFO with the link https://unifiedportal-emp.epfindia.gov.in/

- Here the employer needs to Login to the portal with his/her username and password.

- After Login, he/she can search for the employee in two ways: (a) With the PF account number or (b) with the UAN.

- In the next page, the employer will be able to see the details with the help of four tabs. The four tabs are: (a) Profile (b) KYC (c) Missing Details and (d) Mark Exit. To complete the incomplete information of the employee, the employer needs to open the tab ‘Missing Details’.

- Now enter the missing details with all the accuracy and then click on the tab ‘Update Missing Detail’.

- If all goes well you will get a pop-up message box saying that the update is successful.

- But the process is not complete here, now the employer needs to approve this missing detail request. There will be a small window on the screen stating the employer that ‘Following Record is pending for approval please APPROVE HERE. Just click on the Blue Highlighted ‘APPROVE HERE’ highlighted hyperlink.

- After this, the employer will the Pending Missing details. If the employer wishes to see all the changes made, he can do so by clicking on the option ‘View PDF’. If the employer feels satisfied, he/she can click on the ‘Approve’ tab.

- Now again a new message will appear that the ‘Missing Details approved successfully’. Now the process is complete.

How to Merging Multiple EPF accounts with UAN?

The new process is well defined and only requires one to have the login details.

- First one need to login to the EPFO website portal.

- On the homepage directly go to the menu bar and select the tab ‘our services’

- On clicking the above option a sub-menu will show indicating option like ‘for employee’

- A new service page will show under the employees tab.

- Now select the option ‘one employee-one EPF account’

- You need to fill the required information on the give spaces.

- Click on the generate OTP, automatically the OTP will be sent to your registered mobile number which is connected to the UAN and Aadhaar card.

- Now enter the old EPF account ID then accept the terms and conditions provided o the page.

- The system will automatically link the EPF account to the UAN.

How to Know the Services provided in Epf India and Unified Portal website?

How to know my PF account is created or not?

Visit EPFO portal and go to the ‘For Employees Page.’ This link can be found under ‘Our Services’ section. Click on ‘Member UAN/Online Service’ and enter your UAN details together with Captcha. Select ‘Track Claim Status’ which can be found under ‘Online Services.’ You can see the status of the claim on the next page.

How to Update EPF passbook?

The passbook is updated by EPFO official portal as soon as a contribution made in the account. Even though the date not given in the EPF passbook, it obtains month and year where the donation made. In case you made the find your EPF passbook updated. You have to get the updated passbook.

How to View and edit the profile detail in Unified Portal?

First, the employee needs to mark the changes on the unified portal and send it to the employer. Now the system will make an automatic comparison of the edited details with that of the Aadhaar. If the verification gets successful then only the request will be transferred to the employer. Now it is the turn of the employer to forward the request of the employee to the EPFO. The EPFO will then make the requisite corrections.

How much money is deducted from the Salary to EPF contribution?

Actually, you and your employer both contribute for the EPF. 12% of your basic salary (including DA (Dearness Allowance)) goes into your EPF. Out of this 12%, your employer contributes 3.67% and you contribute the remaining 8.33%. If the salary is above Rs. 6,500, the employer can contribute only 8.33% of 6500 and not more than that. It means that only Rs.541/- goes to your EPF account from the employer’s side and not more than that. It is independent of your basic pay.

The money of the EPF that gets collected by the EPFO from employees like you is then invested by a trust with a rate ranging from 8% to 12%. The rates are decided by the board of trustees at the central level and the government. Remember, if you change your job, update your EPF information as well. There is no tax applied on the EPF by the government.

Note: If anyone want to update your name in UAN portal you need to fill the Joint Declaration form in Unified Member portal. Once submit the joint declaration form it will sent for Employer approval and then EPF officials will have to approve the same.

How to check Central Government Pension?

Visit EPFO website and click on the ‘Pensioners Portal’ option. On the new page that appears on your screen, you have to select ‘Central Government Pension’ option. Enter your PPO number in the space set aside for this detail. Select a month to check PPO status and click on the ‘Submit’ button.

How to activate multiple UAN with one Aadhaar?

Visit the EPFO website and under the ‘Services’ tab, you need to click on ‘One Employee-One EPF Account’ button. A form will open for consolidating multiple accounts. Fill all the required details in the form before clicking on the ‘Submit’ button. Keep in mind you must enter your registered mobile number on the UAN portal.

How to know the Status of Universal Account Number (UAN Status)?

Visit the EPF Portal and click on ‘Our Services’ option on the dashboard. Here, select ‘For Employees’ before clicking on ‘UAN Online Service (OCS / OTCP)’ option. Click on ‘Know Your UAN Status’ link and enter your PF number, Member ID, PAN or Aadhaar. Fill in all other details including OTP and click on ‘Validate OTP and GET UAN’ to receive the UAN number and its status as a message in the registered mobile number.

Dear Sir,

How will I check the composite claim form pf claim application status submitted manually without uan number

SIR/MADAM

MY NAME IS MANJUNATH.N . I have completed 2 years experience in sun & ski exports pvt.ltd. as a maintenance / mechanic (id 9632) date of joining 14.04.2006. my PF no : 19256/6940 , i have applaid for the PF 2 times but i did’t get any PF amount. Again i applaid for the PF ON 13.02.2020 Please check & approve the my PF amount .

Dharitri Mohanta

21/02/2020 at 16:53

SIR/MADAM

MY NAME IS Dharitri Mohanta. I have completed 3 years experience shahi export private limited exports pvt.ltd. as (id 10049911) date of joining 24.11.2015. my PF no : YYBOM00130490000378590 my UAN no 100595246979 , i have applaid for the PF 2 times but i did’t get any PF amount. Again i applaid for the PF ON 13 .3.2020Please check & approve the my PF amount .

Reply

Mere मेरे मोबाइल नंबर चेंज करना है मेरे पुराने मोबाइल नंबर यह है 9165206227 यह है अब नए मोबाइल नंबर अपडेट करना है मैंने मोबाइल नंबर यह है 9770199050 इन को अपडेट करना है मेरे आधार नंबर यह है 577354057607 अपडेट करना है पीएफ में यह नंबर भी भेज दो

मेरी आईडी है sf0028701है 2015 mein spandana sphoorty limited company mein kaam karta tha ok

Hi Sr mere fhaders Rajendra singh maurya he is ko aktibet krne ki krp kre