Guidelines on how to recover forgot UAN password reset in unifiedportal-mem.epfindia.gov.in/….

In case you lose or forget your UAN password or UAN number, do not scare. The Employment Provident Fund Organization (EPFO) has provided the facility to enable the members to edit their details like resetting their passwords. This means that if you had lost or forgotten your UAN login password and UAN number you can easily edit them from the EPF account and recover your account back.

Here is a step-by-step procedure on how members can recover their lost UAN password and reset to new ones that are easy to remember

Change or Forget UAN Password or Reset UAN Login Password

A complex password they registered with may confuse some employees. You can change or Reset UAN Login password using your Universal Account Number or your Provident Fund Number. If you forgot your pin, this is how you reset it;

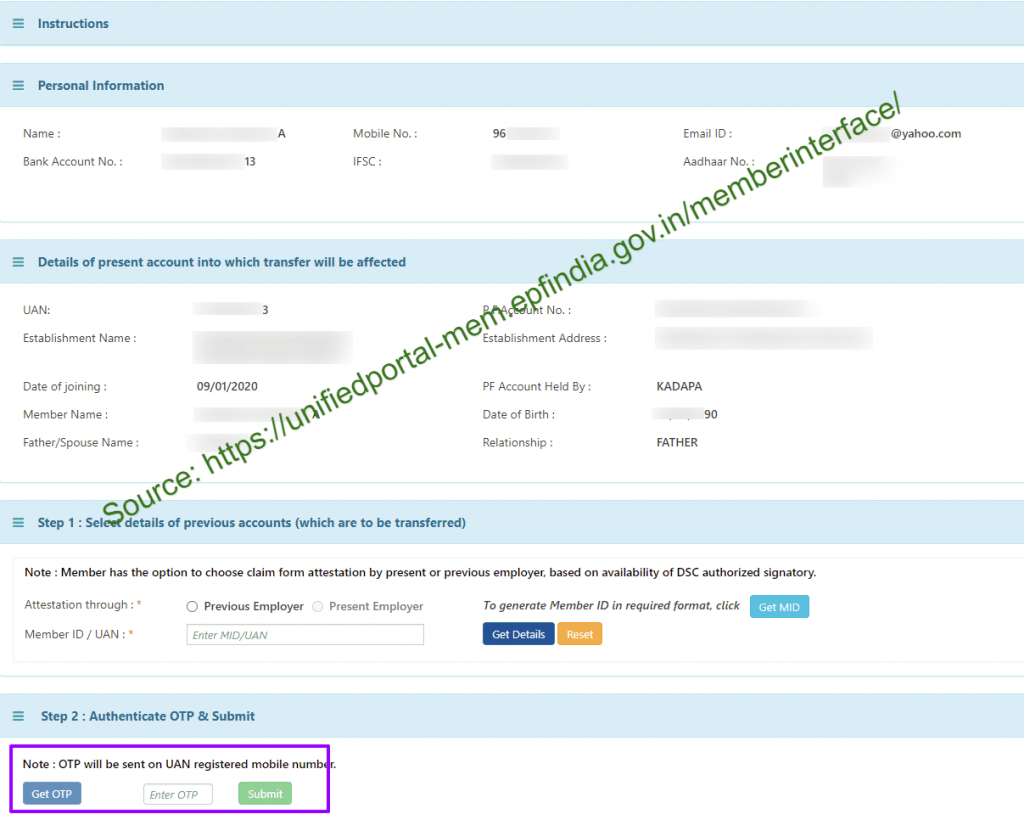

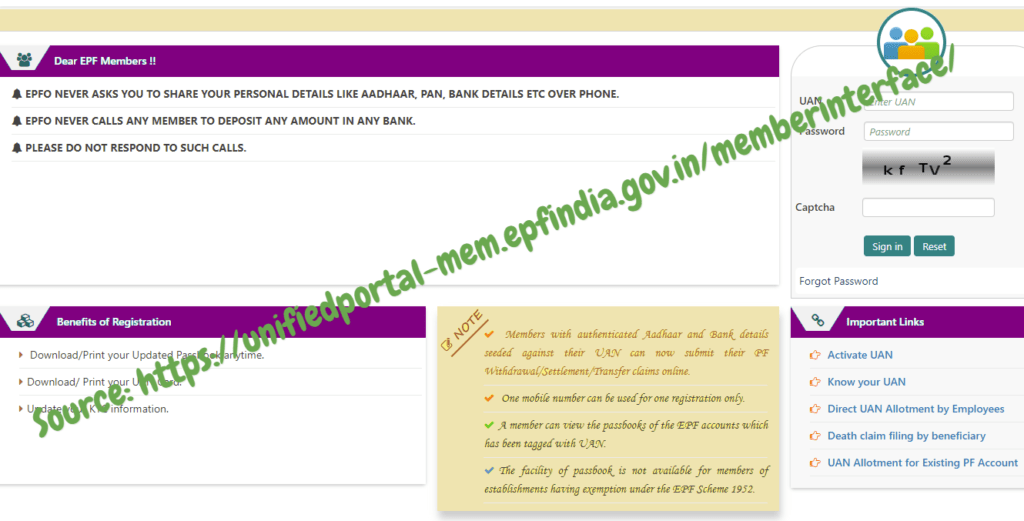

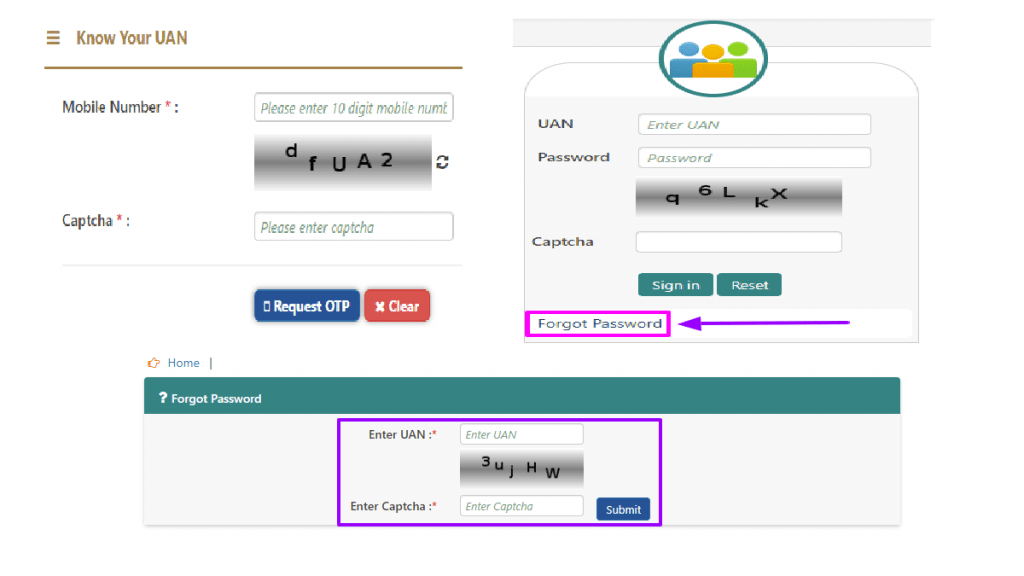

- Visit the official Employee Provident Fund Organization (EPFO) official website using this link https://unifiedportal-mem.epfindia.gov.in/.

- On the login page, click on the option ‘Forgot Password’, which is on the right-hand side of the home page.

- You will be redirected to another page, click on the option ‘Forget UAN Password’ or ‘Forget Password’ to be then redirected to yet another page.

- Coming to the redirected page, you will be requested to ‘Enter UAN’ number and the Captcha code given below. After key in them incorrectly clicks on the ‘Submit’ option.

- Where you will enter your Universal Account Number UAN and your registered mobile number. Finalize by clicking on the option,’ Yes.’

- A one-time password will be automatically sent to your registered mobile phone. Enter it in the provided space and then click on the option, ‘Verify.’

- Once the password has been verified, you will be allowed back into your account where you can reset or change your password to your desired password.

- Create the new password and ensure that you create one that you can easily remember or relate to, re-enter it for confirmation and then press the ‘Submit’ option.

- Once the password has been successfully reset, you will now be able to log in using your Universal Account Number and confirm all your details.

- To confirm if your login details have been successfully saved, log out of the Employee Provident Fund Organization website.

- After logging out, you will be taken back to the EPFO website home page with the option to log in.

- Fill in the login form using your new password, the form is found on the right side of the home page.

- You will also be required to key in your Universal Account Number and the new password you created.

- Type in the Captcha codes given below to verify that you are not a computer.

- You will then be redirected to your home page where you can see your Employee Provident Fund statements and many more. You can download it if you wish.

Using the above methods, employees can easily reset or change their password in case they lose or forget their initial passwords. It is important for members to use passwords that they can easily remember. The methods are quite easy, and this will help you continue enjoying the online services offered by the Employees Provident Fund Organization (EPFO).

How to Change / Forgot / Reset UAN Password at unifiedportal-mem.epfindia.gov.in?

How to change UAN Password?

Go to EPFO Member portal and login to your account by typing in your login credentials before clicking on ‘Log In’ button. On the top menu bar, you need to click on the ‘Account’ option. Select ‘Change Password’ option and enter your old password. Enter you=r new password and confirm it. Once done, click on ‘Update’ and you’ll receive a notification of password successfully changed.

How to Reset / Forgot UAN Login Password?

Visit EPFO Member or e-SEWA website login page, Here, click on the ‘Forgot Password’ on the right hand side. Enter the UAN number and Captcha code before clicking on the ‘Submit’ button. You should then enter your UAN again, registered mobile number and OTP sent to your phone. After OTP verification, enter the new password twice. Finally, click on ‘Submit’ button to apply the changes.