Let’s see What is the EPF vs PPF (Employees Provident Fund vs Pensioners Provident Fund)….

EPF is the common term used in referring to Employees Provident Fund, a government run scheme to all Indian employees of the organized sector. Members of the EPF are required to contribute 12% of their monthly basic salary towards this scheme. They can then access these savings as soon as they retire or when one is rendered jobless.

Public Provident Fund on the other hand is a savings scheme operated by the government and can be accessed by every person regardless of whether you are self-employed, employed, unemployed or retired. PPF is not mandatory and there is no specific amount of money that you have to contribute as is the case with EPF. Epfindia.gov.in is the official website. In this post, we are going to have a look at some of the differences which exist between EPF vs PPF.

Eligibility Criteria

PPF is made available to every Indian citizen regardless of whether you have a source of employment or not. This means that students, self-employed, employees and retired people of India can become members of the PPF. On the other hand, EPF is only made available to salaried employees of a company registered under EPF Act. You can therefore not become a member of EPF lf you have no source of employment.

Investment Amount

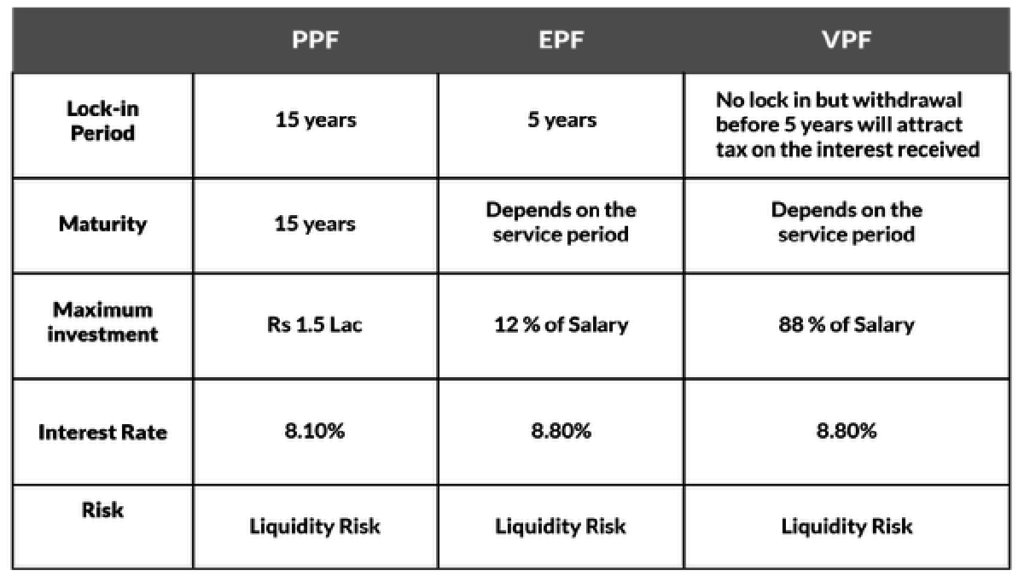

All members of the Employee Provident Fund will have to part with 12% of their basic salary every month towards EPF savings account. However, you can increase the contribution voluntarily depending on your monthly salary and financial muscle. For PPF members, there is no fixed amount that one needs to contribute. You will only have to make a minimum contribution of RS.500 and a maximum savings of RS.1.5 lambs per year.

Tenure

When it comes to tenure, EPF allows its members the chance of closing their accounts as soon as they quit the current job. One can also opt to transfer the account whenever they decide to change a company. Members of PPF are easy required to make the saving for 15 years after which they can extend for a block of 5 years indefinitely.

Governing Act

The Public Provident Fund is governed by the Government Savings Banks Act,1873 which has now been revised to Public Provident Act,1968. On the other hand, EPF scheme is under the Employees Provident Fund and Miscellaneous Provisions Act, 1952.

Taxation

Any investment in EPF qualifies for a tax deduction under section 80 Crores of the Income Tax Act. The taxation is applicable to both the Employees and Employers contribution. Interests and withdrawals from EPF are tax free unless a member decides to access the savings within 5 years after opening the EPF account.

When it comes to Pensioners Provident Fund, any investment in your account up to Rs.1.5 lakh per year will get you a tax deduction under section 80C of the income tax act,1961. The interest and maturity amount are also exempted from tax as is the case with EPF.

These are just some of the differences that exist between EPF vs PPF. The good news is that both the EPF vs PPF tend to be a safe method of statutory backing.

How to get Both EPF and PPF ?

How to get EPF?

To get EPF, you should first sign in to the UAN Member Portal. Click on the ‘Online Services’ and select ‘Claim (Form-31, 19 & 10C) from the drop down-menu. Proceed for online claim by clicking on this option and select ‘PF Advance (Form 31).’ It is then that you have to follow the prompts that appear on your screen to get EPF.

How to Get PPF?

You can open PPF account offline at your nearest post office. All it takes is for you to get an application form at the post office and fill all the required details correctly. Attach the necessary documents and submit the form together with the initial deposit. Once your details are verified, your PPF account will be opened.