Procedure on National Pension System NPS Account Registration and NPS Amount Withdraw process by login into enps.nsdl.com/eNPS/ website……

What is National Pension System (NPS)? It is for this reason that the National Pension System (NPS) was launched by the Government of India. NPS is a low cost government sponsored scheme that was launched in 2004 with the aim of serving all employees of the government. Epf India official website is epfindia.gov.in

Who can apply for the National Pension System (NPS)?

Any Indian citizen who is 18-60 years as on the date of submitting their application to the Points of Presence Service Providers is eligible to apply for this scheme. You can either decide to join this scheme as an individual or using the employer-employee group so long as all the details and KYC documentation are submitted to the application authority.

How to Open a New NPS Account Registration in enps.nsdl.com/eNPS/

Once all these requirements are in place, you can proceed to open an NPS account online by following the simple step by step explanation given below:

- On the search bar of your browser, type in https://enps.nsdl.com/eNPS/ to log on to NPS Trust Website.

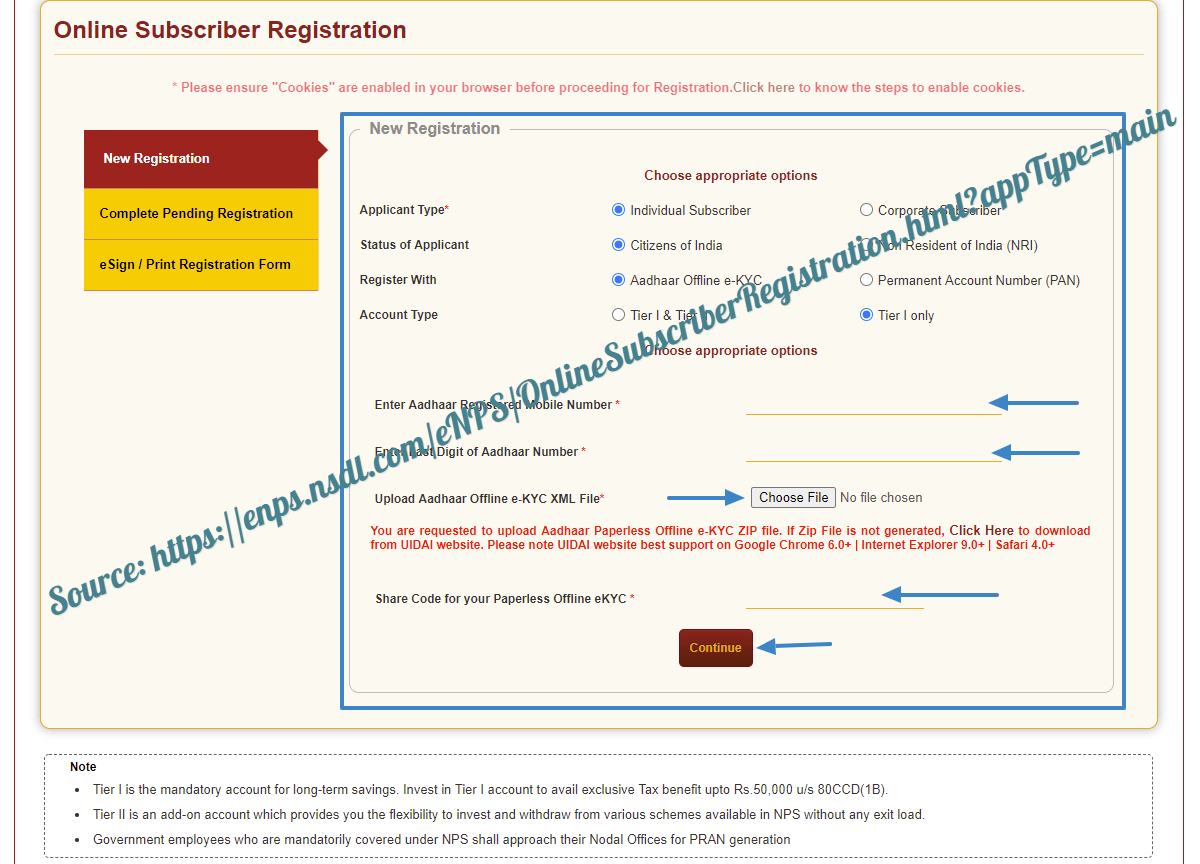

- Once in the website, click on ‘Registration’. This action will automatically redirect you to the online subscriber registration page. Here, click on ‘New Registration’ option and select ‘Individual’.

- There was several options to choose in the New Registration Form.

- Choose the ‘Application Type’ either ‘Individual Subscriber’ or ‘Corporate Subscriber’

- After choose the ‘Status of Application’. If you are local in India choose ‘Citizens of India’ if you are non local then choose ‘Non Resident of India’

- Coming to the next step you must again choose Register with either ‘Aadhaar offline e-KYC’ or ‘PAN’.

- Enter your 12- digit Aadhaar number or the Virtual ID number before clicking on “Generate OTP” button.

- Enter the OTP that will be sent to your registered mobile number after which you should click on ‘Continue’. Any person who is using the PAN Number will have to wait for their bank to verify their details. This action will cost you Rs 125.

- Once you have selected ‘Continue’ you will be able to get an acknowledgement number that contains your name. Select “OK” after you receive these details.

- Correctly fill in your personal details and then click on ‘Save and Proceed’ button.

- You will then be required to enter your banking details. Remember to use a bank account that has Net Banking Facility. Click on ‘Save and Proceed’ once this is done.

- This next step involves selecting the portfolio allocation from the four funds that are currently available i.e. corporate bond fund, government securities fund, alternative investment fund and equity fund. Once you have filled in the allocation details you will have to provide the details of people who will get the Corpus in case an investor dies.

- Upload your Scanned signature image, Passport size photograph and a cancelled cheque of your bank account.

- Finally, you will have to make your first contribution with a minimum of Rs 500 for Tier 1 and Rs 1000 for Tier 2.

- Once the payment has been made successfully, you will be given a Permanent Retirement Account Number (PRAN) together with the payment receipt.

- You will then be required to access the print registration page from where you are to select e-Sign with Aadhaar Card. Key in the OTP that will be sent to your registered mobile number for the Aadhaar to be authenticated. Your registration will now be signed electronically.

How to Withdraw NPS Amount

A member of NPS can only withdraw their funds in only three scenarios i.e.

- Death of the subscriber.

- Premature exit

- Superannuation

The online withdrawal can be initiated by using any of the two methods given below:

- Using the user ID and IPIN -The subscriber can decide to directly request for a withdrawal application using their own personal user ID and IPIN in the CRA system. This action should be done within a period of six months before the superannuation date that was selected by a subscriber. While requesting a withdrawal, the subscriber must give the Nodal office relevant bank details, Nomination details, Lump Sum percentage to be withdrawn, Annuity Service Provider details and annuity percentage share details.

- By POP / Nodal office / Aggregator- When the subscriber cannot initiate the withdrawal request directly into the system then it can be initiated by a concerned POP/Nodal Office/Aggregator by using their logins. The subscriber will then be asked to submit physical withdrawal form together with other documents such as bank details, address proof and identity proof. These documents should be issued to the Nodal office.

In case a subscriber dies, then the POP / Nodal office / Aggregator will have to initiate a withdrawal request via the respective logins into the CRA system. The KYC documents will also be looked into after which the authorization request will be initiated by the Nodal Office who will have to forward all documents submitted by a claimant.

How to Register NPS Account Online Registration at enps.nsdl.com/eNPS/?

How to Register NPS account online?

Logon to NPS Trust Website, after which you should click on ‘Registration’ option. Choose ‘individual’ and enter your Aadhaar or PAN number before selecting the type of account. Enter the OTP sent to your registered mobile number together with your personal details. Fill in all the required details and download the duly filled form. Take a printout of the form, stick your photo, sign it and mail to CRA office.

How to activate NPS account online?

To activate your ‘freezed’ NPS account, you need to visit their official website and download form UOS-S10-A. you will then that to fill the form correctly before submitting the form. The authorities then verify whether the contribution accepted is greater than the minimum prescribed to keep the account activate. If everything is okay, the application is processed and the PRAN is activated.

How to check NPS Account Status?

Login to NSDL website link and select the ‘New Registered PRAN’ option. Enter the PRAN number allotted during registration before entering the Captcha as it appears. You will then have to click on the ‘Submit’ button. You can now see the status of registered PRAN on the screen of your device.